In the dynamic realm of finance, a concept has emerged with the potential to reshape the industry as we know it: tokenization. This innovative process involves linking traditional financial assets to digital tokens traded on distributed ledgers, opening doors to a new era of digital securities. Deloitte's recent whitepaper delves into the intricacies of tokenization, exploring its transformative possibilities and the challenges it presents.

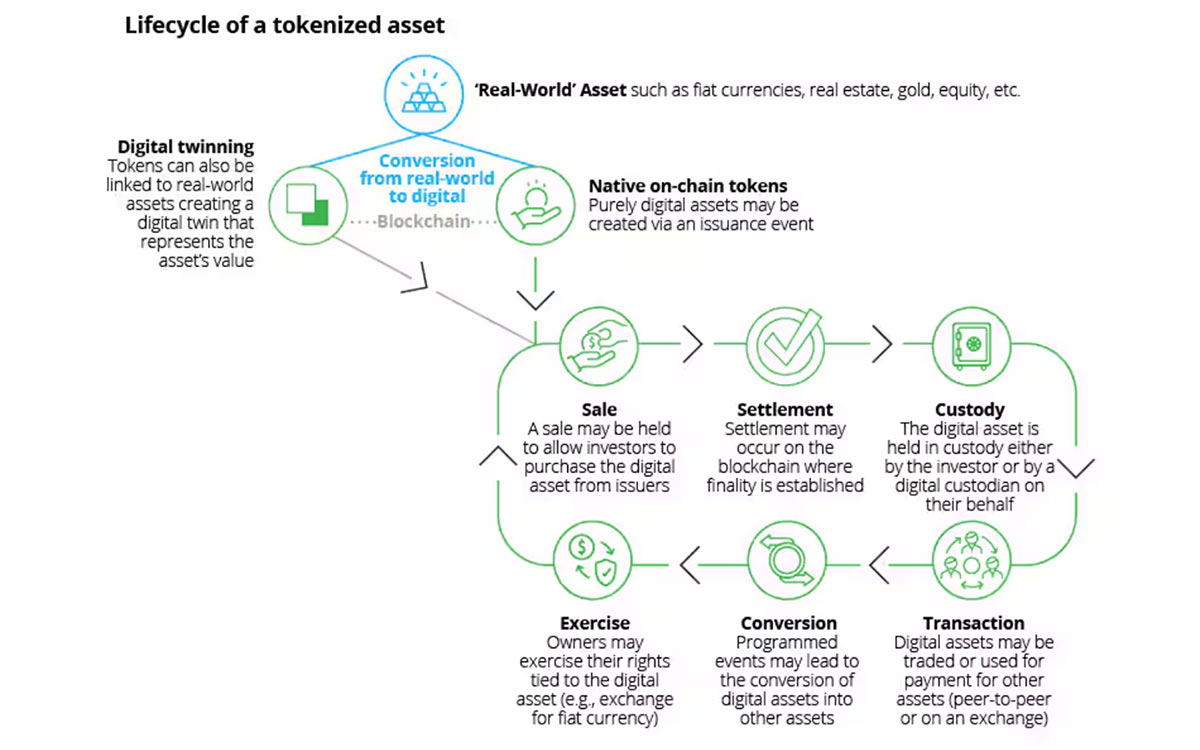

Tokenization offers a compelling vision of the future, promising to revolutionize the way financial assets are traded and managed. By digitizing assets such as unrestricted common stock, bonds, exchange-traded products, and commodities, tokenization enables fractional trading and broadens access to previously illiquid markets. This democratization of access has the potential to attract new investors and unlock untapped value in the financial ecosystem.

However, realizing the full potential of tokenization requires overcoming a series of challenges. Regulatory uncertainty looms large, with many jurisdictions lacking clear guidelines for tokenized securities. This ambiguity complicates compliance efforts for financial institutions, who must navigate a complex regulatory landscape while ensuring adherence to existing laws and regulations. Yet, there are signs of progress, with proactive regulators in some regions issuing guidance and creating sandboxes to facilitate innovation in the tokenization space.

Privacy concerns represent another significant hurdle for tokenization efforts. While distributed ledgers offer unprecedented transparency, they also raise questions about data privacy and security. Striking the right balance between transparency and privacy is essential to building trust among investors and fostering widespread adoption of tokenized assets.

Integration with legacy systems presents yet another challenge for institutions embarking on the tokenization journey. While tokenization holds the promise of streamlining operations and reducing costs, the process of integrating new technology with existing systems is fraught with technical complexities. Financial institutions must navigate regulatory approvals, legal considerations, and system upgrades to fully leverage the benefits of tokenization.

Moreover, tokenization introduces a host of tax and accounting implications. From capital requirements to valuation methodologies, financial institutions must navigate a maze of regulatory requirements and tax considerations. While tokenization may simplify certain accounting processes, it also poses new challenges in determining the legal status of tokenized assets and their tax treatment.

Despite these challenges, the potential benefits of tokenization are too significant to ignore. Early adopters of tokenization stand to gain a first-mover advantage, shaping industry standards and establishing themselves as leaders in this emerging ecosystem. By fostering a culture of collaboration and innovation, financial institutions can position themselves at the forefront of the tokenization revolution.

In conclusion, tokenization represents a paradigm shift in the world of finance, offering a pathway to unlock new markets, streamline operations, and drive innovation. While challenges remain, proactive regulatory initiatives and industry collaboration can pave the way for widespread adoption of tokenized assets. As financial institutions navigate this transformative journey, those who embrace tokenization early stand to reap the rewards of a future powered by digital securities.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer’s expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to digital asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to digital asset securities to isolate risk and having policies and procedures to, among other things, assess a given digital asset security’s distributed ledger technology and protect the private keys necessary to transfer the digital asset security.