Abstract

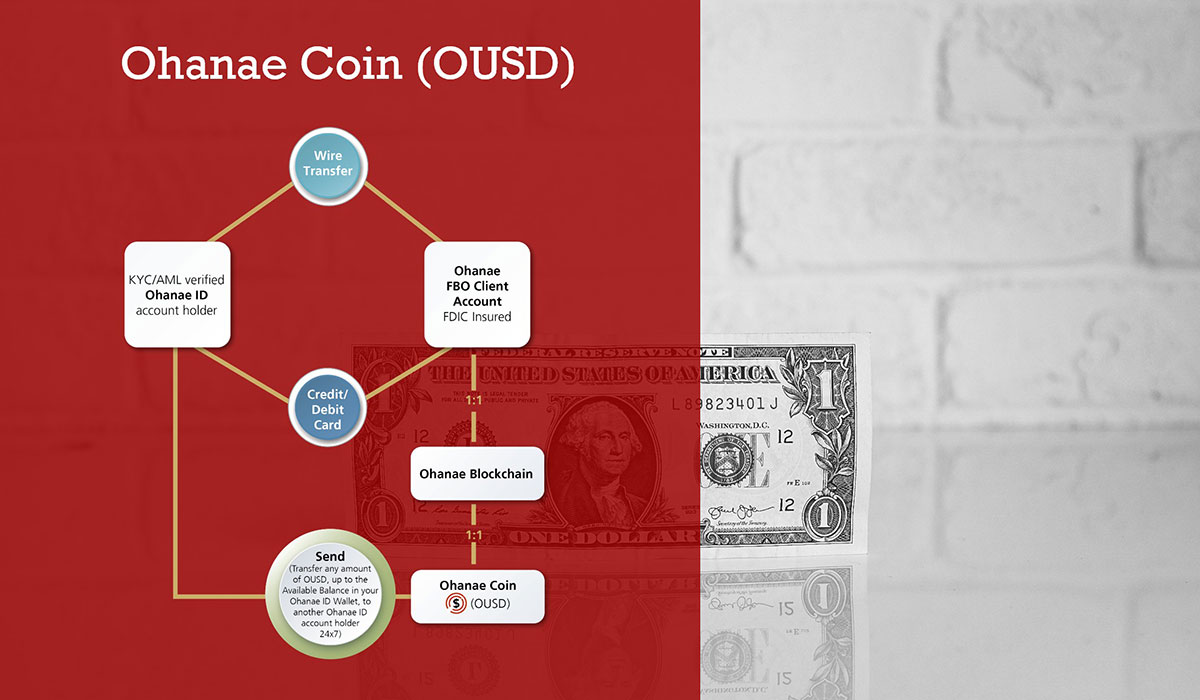

Ohanae Coin (OUSD) is a USD-backed, fully redeemable covered payment token issued by Ohanae Securities LLC, a wholly owned subsidiary of Ohanae, Inc. Designed for the regulated settlement of equity tokens in an Over-The-Counter environment outside national exchanges, OUSD is backed 1:1 by U.S. dollars held in a Special Reserve Account (SRA) for the Exclusive Benefit of Customers under SEC Customer Protection Rule 15c3-3.

OUSD is programmable, KYC-restricted, and non-speculative — all yield generated from underlying cash reserves is retained to strengthen coverage, eliminating any expectation of profit. It forms the settlement foundation of Ohanae's compliant tokenized securities market.

Commercial Bank Money: Reimagined for Tokenized Securities

OUSD functions as a regulated payment token, not a public stablecoin. Operating exclusively within the Ohanae ecosystem, it enables instant, atomic settlement of tokenized securities while maintaining full compliance with SEC and FINRA rules.

Each OUSD is issued only when customer funds are deposited and held in segregated SRAs at FDIC-insured U.S. banks, providing true 1:1 cash backing. It is redeemable on demand at par, ensuring that customers always have direct, dollar-for-dollar claims on underlying cash.

Key Features and Use Cases

- Settlement Instrument: Enables instant, on-chain delivery-versus-payment (DvP) settlement for tokenized securities.

- Programmability: Smart contract-enabled for automated compliance, auditability, and transfer restrictions.

- KYC-Restricted Access: Available only to verified Ohanae ID users, ensuring BSA/AML alignment.

- 1:1 Reserve-Backed: Each OUSD is fully backed by cash in SRAs at regulated banks.

- Non-Speculative Design: No yield distribution; reserve earnings strengthen liquidity coverage.

- Fee-Efficient Transfers: Internal OUSD transfers are instant and fee-free.

The Special Reserve Account (SRA): The Foundation of Trust

At the core of OUSD's design is the Special Reserve Account, a regulatory mechanism that ensures customer protection and transparency:

- Full Segregation: Customer reserves are never co-mingled with firm capital.

- FDIC-Insured Custody: Deposits are distributed across insured banks to maximize coverage.

- Continuous Compliance: Automated reconciliation and monitoring enforced 24×7.

- Third-Party Attestation: Periodic audits verify 1:1 reserve integrity.

Every OUSD token is minted only after fiat funds are verified and received, and is burned upon redemption — ensuring that OUSD in circulation always equals verified reserves.

Regulatory Classification

Following the GENIUS Act framework, OUSD is defined as a "covered payment token."

It is not a public stablecoin, not a bank deposit, and not a money market fund share. Instead, OUSD is a fully reserved, redeemable payment obligation of Ohanae Securities LLC, issued under SEC Customer Protection Rule 15c3-3 and supported by the firm's net capital requirements under Rule 15c3-1.

This structure embeds traditional customer protection standards directly into digital settlement — making OUSD a regulatory bridge between U.S. securities law and blockchain finance.

Hybrid AMM Settlement Model: Liquidity Meets Compliance

OUSD powers Ohanae's Hybrid AMM Settlement Model, which blends blockchain-native liquidity with regulated market structure:

- Principal Dealer Execution: Ohanae Securities trades as principal in OUSD-token pairs.

- No Central Order Book: Eliminates ATS complexities while preserving price transparency.

- Passive Liquidity Providers: Other broker-dealers can supply capital passively without routing orders (available in 2027).

- Real-Time Settlement: Every transaction settles atomically — instant cash and token exchange, no intermediaries.

This model provides institutional-grade efficiency within a compliant digital framework, establishing Ohanae as a pioneer of regulated tokenized markets.

Conclusion

OUSD is more than a settlement token — it's a structural innovation for modern finance.

By embedding regulatory principles directly into blockchain logic, Ohanae bridges the gap between Wall Street-grade compliance and Web3-native efficiency.

With OUSD and the Ohanae platform, we are defining the future of capital markets: instant, compliant, and secure.

NYSE. Nasdaq. Now, Ohanae.

Ohanae is a fully custodial, cash-only platform for raising capital and trading tokenized securities — outside traditional exchanges — with instant settlement and no intermediaries.

We're building the regulated tokenized securities infrastructure the market has been waiting for:

- A public-permissioned blockchain for compliant tokenization,

- Stable settlement token (OUSD) for real-time payments,

- Private key custody for secure operations, and

- Continuous liquidity powered by our hybrid automated market-making (AMM) model.

We don't speculate. We modernize capital markets — delivering compliance, safety, and instant settlement.

Confidence. That's Ohanae.

Disclaimer

Ohanae Securities LLC is a subsidiary of Ohanae, Inc. and member of FINRA/SIPC. Additional information about Ohanae Securities LLC can be found on BrokerCheck. Ohanae Securities LLC is in discussions with FINRA about exploring the expansion of business lines for the broker/dealer. Any statements regarding abilities of Ohanae Securities LLC are subject to FINRA approval and there are no guarantees FINRA will approve the broker/dealer's expansion.

Ohanae Securities is seeking approval to be a special purpose broker-dealer that is performing the full set of broker-dealer functions with respect to crypto asset securities – including maintaining custody of these assets – in a manner that addresses the unique attributes of digital asset securities and minimizes risk to investors and other market participants. If approved, Ohanae Securities will limit its business to crypto asset securities to isolate risk and having policies and procedures to, among other things, assess a given crypto asset security's distributed ledger technology and protect the private keys necessary to transfer the crypto asset security.